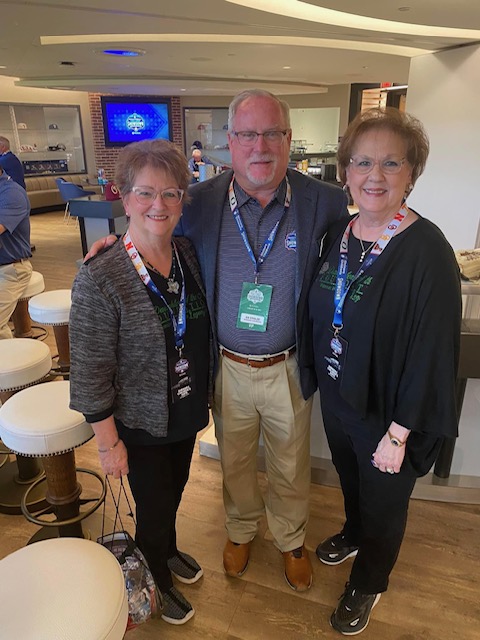

President of the Daughters of the Nile Foundation Herbie Kay Lundquist and Director of the Daughters of the Nile Foundation, Vickie Tabor-Hill and Imperial Potentate Ed Stokes.

January 3, 2024

3rd million dollar plaque presentation to Shriners Children’s Southern California. President of the Foundation Herbie Kay Lundquist and SQ Patty Larimore.

Thrilled Imperial Sir Ed Stolz and Imperial Sir Jerry Gantt were able to join us along with board members Joni Lerud-Heck and Margaret Silvers. More pictures to come

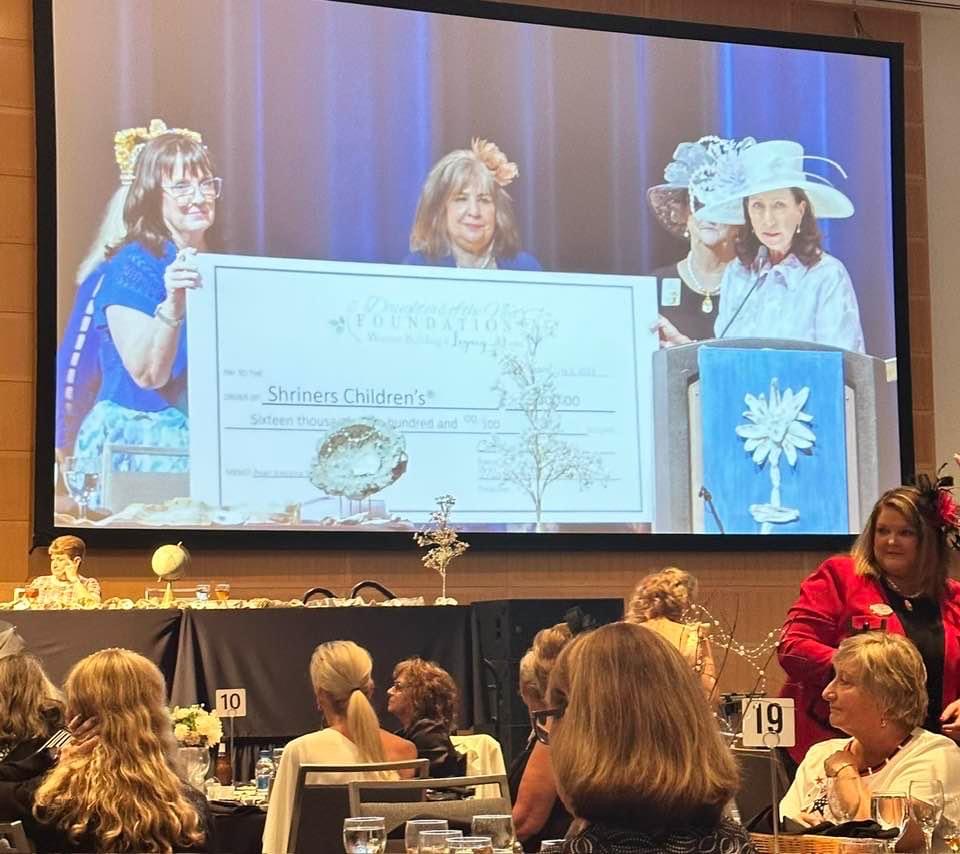

Imperial Ladies Luncheon Daughters of the Nile Foundation check presentation to Jennifer “JJ” Craven in Charlotte, North Caroline. Left to right: President of the Daughters of the Nile Foundation, Carolyn Dobbs, Past First Lady Wanda Dunwoody and First Lady Jennifer “JJ”Craven. Second Row. Supreme Queen Patty Larimore and Past Supreme Queen Vickie Hill.

Left to right: Supreme Queen Patty Larimore, Princess Royal, Jackie Holloway, Princess Tirzah Kathy Walliker, Princess Badoura Kathy Rafter and President of the Daughters of the Nile Foundation USA Carolyn Dobbs

At Imperial Daughters of the Nile Foundation USA and Canadian Check presentation in Charlotte, North Caroline

Craig McGhee, Midwest Market Administrator, Jim Doel, Imperial Liaison for the Chicago Shriners Hospital, Herbie Kay Lundquist, Vice President, Daughters of the Nile Foundation, Marsha Schandelmier, Treasurer, Daughters of the Nile Foundation, Dan Winters, Donor Development Director, and Matt Lucas, Director of Fiscal Services for Chicago.

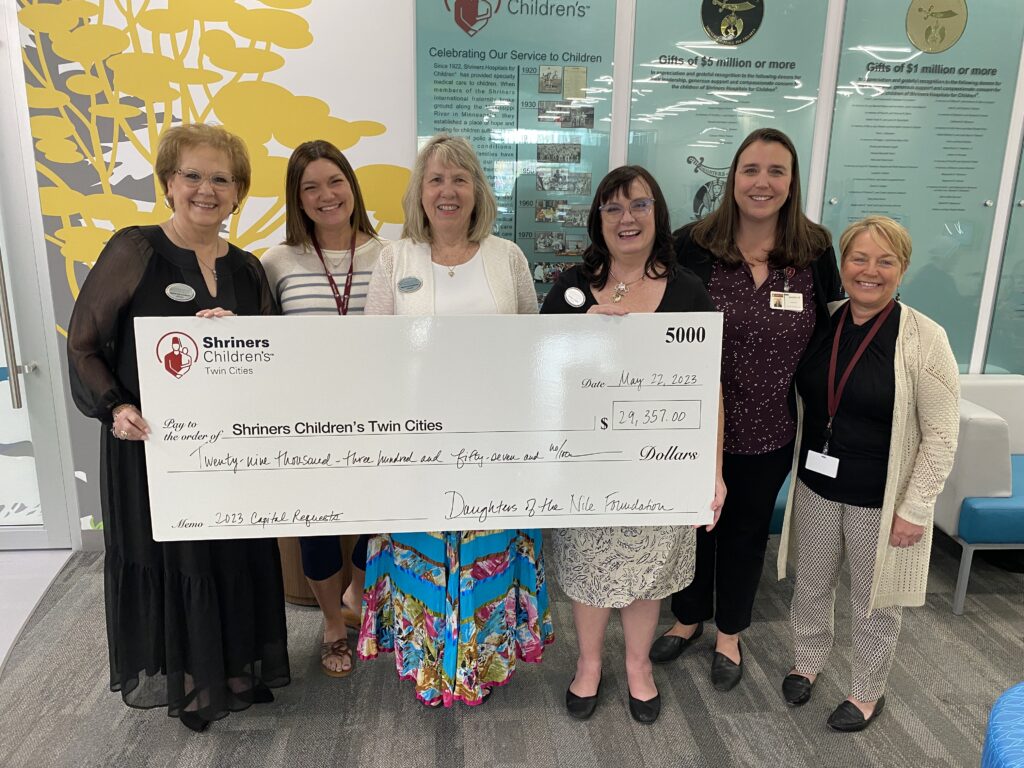

Shriners Children’s Twin Cities

Left to right: Herbie Kay Lundquist, Vice President of the Daughters of the Nile Foundation, Melissa Forrest, Ancillary Services Manager, Marsha Schandelmier, Treasurer of the Daughters of the Nile Foundation, Carolyn Dobbs, President of the Daughters of the Nile Foundation, Jennifer Sutch, Director of Development and Theresa Barlow, Stewardship Coordinator.

Shriners Children’s Greenville SC

For a century, the women of the Daughters of the Nile Foundation have been transformational partners in Shriners Children’s commitment to care. Carolyn Dobbs, President of the Daughters of the Nile Foundation, visited Shriner’s Children’s Greenville to make the first of the Foundation’s 2023 investments in the hospital. Thank you, Carolyn and Daughters of the Nile, for helping us provide the Most Amazing Care Anywhere.

We welcomed Supreme Pr. Tirzah Jackie Holloway, PQ Marsha

Schandelmier, PQ Kathy Gough, PQ Charlla Sistrunk, and PQ Maria Boyer-Jensen,

Directors of Daughters of the Nile Foundation and Queen April Bierman and members of

the Daughters of the Nile, Egyptian Temple No. 33. During their special visit to our hospital,

DON Foundation presented a surprise donation of over $33,000, which will be used to

purchase a new Bone Mill and Food Steamer. The visit was made extra special when

Queen April Bierman and DON Egyptian Temple No. 33 made an additional donation for

patient care and family support.

We extend our heartfelt mahalo to the Directors of Daughters of the Nile Foundation who

have traveled great distances to visit our hospital and DON Egyptian Temple No. 33 for

their dedicated support of our mission. Your generous donations will go a long way in

extending the highest quality of care and nutrition to our keiki and their families!